I have chronic heartburn and I have to take medication for that heartburn. The best drug that works for me is Nexium. But, I don't take that because my insurance co-pay for it is too expensive. If I did take that, I would only have to take one per day.

Because Nexium isn't a preferred drug on the insurance policy, I have to take two per day of Prilosec (or its generic equivalent). So, instead of 30 pills per month, I take 60 pills per month. If I miss a pill, I have a horrible few hours until the next pill kicks in.

I thought I would do a little research on what the real cost is.

The total cost per month for my prescription is $153.99. Because I have a reasonable insurance plan, my co pay for that drug is $10.00 and the pharmacy is proud to say that I "saved" $143.99.

I decided to look at Amazon.com for comparisons.

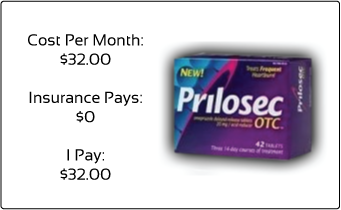

Here is what I found. I can buy my drugs over the counter, with no prescription, the brand name version Prilosec OTC for $32 per month. But, the insurance company doesn't pay anything; I am responsible for the full price.

I can also buy a generic version of the drug for $26 per month. Again, the insurance company is not willing to pay anything, so I have to pick up the full tab.

For the longest time, I chose, like most people do, to have the insurance company pick up the cost. I figured the economic choice is simple. I can pay $10.00, $26 or $32 per month. I've always figured I paid $600 per month (now, $1,000 because of Obamacare) for my plan, I was going to use it to it's fullest.

Why should I pay 3 or 4 times the cost when I already am paying my insurance company so much to do that for me.

Which would you choose?

I find this fascinating because they are the exact same drug. Exact same dosage. Different package and different marketing route.

I think my head will explode if I hear one more politician say that we need health insurance for everyone. I am at the edge of dumping mine because of stupid pricing schemes like this one.

I do understand that one of the key reasons for this pricing scheme is that there is greater overhead buying through an insurance company. The pharmacy essentially has to finance your purchase until they are reimbursed. The insurance company has an administrative staff that makes sure the claim is within plan. The accounting department has to transfer the funds.

All the while, there is a greater burden put on the system.

I know that it will take responsible consumers to change the system and not abuse the system. As a result, I now pay more out of pocket for my prescription instead of going through the insurance to get it.

Hey, insurance company, I'll tell you what. I'll give you a $30 co-pay for a six month supply if you let me buy the generic over the counter stuff... I'll save $252 per year and you'll save $1,595.

Oh... they really didn't save me $143.99... they saved me $16.

One last thing. Did you know that most insurance plans don't actually pay for your prescriptions drugs? Most of them actually just roll the cost of all prescriptions paid last year into a premium increase this year. So, by being irresponsible in using the prescription drug insurance in this way means that everyone on the plan pays more down the road. Cool, huh?